The Jefferson Parish Sheriff’s Office is asking voters throughout the parish to approve a new 7-mill property tax on the April 30, 2022 ballot. The Sheriff plans to use the estimated $28 million in annual tax revenue to raise employee salaries by an average of 25% and fill nearly 250 vacant positions. If approved, the 10-year tax would take effect this year and run through 2031.

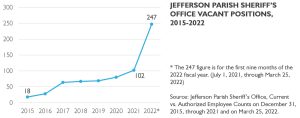

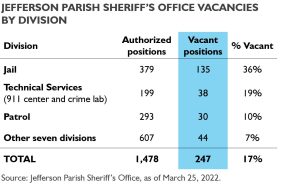

The Sheriff said the new revenue is necessary to (1) address mounting problems with retention and hiring that have left the office understaffed, (2) reduce overtime costs and (3) update a salary structure that has had few significant pay increases since Hurricane Katrina. As shown in the chart below, the number of vacancies has increased nearly 150% in the past nine months. The 247 vacancies as of late March represent 17% of the office’s 1,474 authorized positions.

More than half of the vacant positions are at the parish jail, and consequently, the jail accounts for a large share of the office’s rising overtime costs. The vacancies extend to other key areas of the office’s operations, including 911 dispatchers and patrol deputies. The Sheriff’s Office links the sharp increase in vacancies to hiring and retention problems, largely driven by a salary structure that has not kept up with other law enforcement agencies and the private sector.

The $28 million from the tax would increase General Fund revenues 21% to $162.5 million. The tax would be the primary funding source for a $36.8 million plan to raise salaries and fill all open positions. About $5 million would come from projected savings on overtime costs, with another $3.8 million coming from existing General Fund revenues or reserves. The plan would allocate $18.8 million to increase salaries for all Sheriff’s Office employees by an average of 25%. The remaining $18 million would cover the cost of filling the vacant positions and provide financial reserves to help maintain the raises and higher staffing levels if revenues decline or costs increase more than expected. If voters approve the tax, the Sheriff’s Office would apply $9 million from its current $65.7 million in reserves to implement the raises on July 1, six months before the new tax would be collected.

To analyze the proposition, BGR considered three questions that address the efficient and effective use of public resources: (1) Has the Sheriff’s Office carefully planned how it will spend the tax revenue and provide financial stewardship and accountability for taxpayer dollars? (2) Is the tax an acceptable way to fund the purposes in light of alternative funding options? (3) Is there evidence indicating the tax would result in effective outcomes for the public? Based on this analysis, BGR found the following:

FOR. The Jefferson Parish Sheriff’s proposed 7-mill property tax would provide a stable revenue stream to address growing problems with retention and hiring that could pose a risk to public safety. The Sheriff’s Office would compete more effectively with other agencies for talented officers, recruits and other employees. Its detailed plan for raising salaries and filling vacant positions would align pay more fairly with employee responsibilities, provide a livable wage for most support staff and reduce overtime costs. The office has also compiled a track record of effective financial stewardship and is putting in place a new strategy for recruitment. A timely response as outlined in the Sheriff’s proposal is necessary to prevent the recent spike in resignations from becoming a crisis.

Still, the proposal has some shortcomings that the Sheriff’s Office should address. BGR’s analysis finds that levying the full 7 mills could generate significantly more revenue than the pay raise plan requires, especially in the early years of the tax. The office should seek to control the accumulation of surplus tax revenue by continuing to develop its recruitment and retention strategy to fill vacancies efficiently and effectively. It should also put in place data collection and analysis techniques to understand employee motivations and help ensure the effectiveness of any future pay raises. While rebuilding its workforce, the Sheriff’s Office should look for efficiencies in its authorized positions and publicly document its hiring results and use of surplus revenues. If surpluses persist, the Sheriff should consider lowering the millage rate to avoid overburdening citizens who may themselves be struggling financially. Unnecessarily high taxes in one area can reduce taxpayers’ tolerance to finance other needs in the parish.

This report is part of BGR’s On the Ballot series, which provides voters with objective, nonpartisan analysis of significant ballot propositions in the New Orleans metropolitan area. In producing these reports, BGR recommends positions consistent with its mission of promoting informed public policy making and the effective use of public resources to improve local government. On the Ballot reports highlight the strengths and weaknesses of ballot propositions and assess the potential for government expenditures or actions to efficiently achieve beneficial outcomes for citizens.

Property taxes are a basic means of financing local government, but the public faces a confusing array of tax rates, taxing bodies and dedicated purposes across the New Orleans region. To help explain these taxes, the Bureau of Governmental Research (BGR) today launched an interactive, online tool. BGR’s property tax dashboards for Jefferson, Orleans, and St. Tammany […]

OVERVIEW In this report, BGR explores how the City of New Orleans has deployed pandemic relief funds it received through the federal American Rescue Plan Act, and what impacts this unprecedented one-time money had on City finances and budget priorities.

OVERVIEW In this On the Ballot report, BGR analyzes a new 7-mill, 10-year property tax for the Jefferson Parish Sheriff’s Office on the April 30, 2022 ballot.

OVERVIEW In August, the New Orleans City Council excluded hotel room rentals from a new sales tax for enhanced public safety in the French Quarter despite questions about whether the exclusion is permissible under state law. While BGR has not taken a position on the legal issues, this BGR NOW report identifies several compelling policy […]

OVERVIEW BGR’s report, On the Ballot: French Quarter Sales Tax, April 24, 2021, is intended to help French Quarter voters make an informed decision on a proposition for a 0.245% sales tax to pay for supplemental police patrols and other public safety services. The tax would take effect July 1 and remain in place for […]

OVERVIEW On the Ballot: Jefferson Parish Water and Sewer Taxes, March 20, 2021 provides voters in Jefferson Parish with analysis of two property tax propositions to replace existing water and sewer system taxes. Although the propositions will appear as separate items on the March 20 ballot, BGR analyzed them together because of their similarities. The […]

OVERVIEW On the Ballot: French Quarter Sales Tax Renewal, December 5, 2020 is intended to help French Quarter voters make an informed decision on a proposition to renew a 0.2495% sales tax to pay for supplemental public safety services. The proposition would extend the tax – set to expire at the end of 2020 – for […]

Overview On the Ballot: Jefferson Parish Inspector General Tax Renewal, November 3, 2020 is intended to help voters in the unincorporated areas of Jefferson Parish make an informed decision on whether to renew a 10-year, 0.5-mill property tax dedicated to the Office of Inspector General and the Ethics and Compliance Commission. While the tax is […]

Overview A Look Back to Plan Ahead: Analyzing Past New Orleans Budgets to Guide Funding Priorities reviews a decade of City General Fund budgets. It also lays a foundation for examining potential opportunities to reallocate revenue to critical needs.

Overview Questions for a New Parish Council is the second in a two-part 2019 Candidate Q&A Election Series providing the views of candidates for Jefferson Parish government on important public policy issues, such as tax dedications and contracting. Questions for a New Parish Council provides voters with the candidates’ answers to 16 questions developed from […]

Overview Questions for a New Parish President is the first in a two-part 2019 Candidate Q&A Election Series providing the views of candidates for Jefferson Parish president on important public policy issues affecting Parish government. Questions for a New Parish President provides voters with the candidates’ answers to 16 questions developed from BGR’s body of […]

Overview The report analyzes a May 4, 2019 tax proposition in Jefferson Parish for a new 7.9-mill tax to fund pay raises for teachers and other school employees. The new tax would run for 10 years, beginning in 2019. It is expected to generate $28.8 million in the first year. If voters approve the tax, […]

OVERVIEW Today BGR releases three reports on Jefferson Parish tax renewals for drainage works, juvenile services, and animal shelter and health services that voters will consider on November 6, 2018. If approved, each tax would be renewed for 10 years, from 2021 to 2030. On the Ballot: Jefferson Drainage Property Tax Renewal Voters in Jefferson […]

OVERVIEW This On the Ballot report reviews a constitutional amendment on the November 6, 2018 ballot that would allow eligible homeowners to phase in an increase in property taxes resulting from a reappraisal. The four-year phase-in process would apply only to residential properties subject to the homestead exemption that increase in assessed value by more […]

OVERVIEW This report is the latest installment in BGR’s Candidate Q&A Election Series. The new report consolidates and reissues the responses of the newly elected City of New Orleans mayor and councilmembers who completed BGR’s surveys last fall on important issues facing City government. We encourage citizens to revisit the issues by reviewing the BGR […]

OVERVIEW BGR examines the April 28, 2018, proposition before voters on the west bank of Jefferson Parish to approve a new property tax for the West Jefferson Levee District. This is the Levee District’s second attempt at a new tax to cover the increased costs of raising and armoring levees and maintaining pump stations. The […]

Overview BGR’s On the Ballot report examines the proposed 10-year property tax millage to provide additional funding to increase the pay of Jefferson Parish School Board teachers and other employees.

Overview BGR examines propositions on the October 14, 2017 ballot for 10-year renewal of two existing property taxes to operate and maintain Jefferson Parish’s public transportation system. The report examines a number of issues related to Jefferson transit, including route inefficiencies identified in a Regional Planning Commission study and challenges connecting with public transit in […]

Overview For the October 14, 2017 primary elections in New Orleans, BGR provided voters with its 2017 Candidate Q&A Election Series. BGR submitted questions to all mayoral and City Council candidates on public safety, infrastructure and other important public policy issues facing the City of New Orleans government. BGR compiled the answers of the candidates who […]

Overview BGR’s On the Ballot report examines the proposition on the April 29, 2017 ballot for 10-year renewal of an existing property tax for Jefferson Parish public libraries.

Overview BGR studies four dedicated taxes up for renewal on the December 10, 2016 in Jefferson Parish: a sales tax for parish sewerage, road and drainage projects, law enforcement and municipal governments in Jefferson; and three property taxes for parish drainage, recreation and public schools.

Overview BGR reviews two property tax propositions on the ballot in New Orleans on December 10, 2016: a tax increase for fire protection services for the City of New Orleans and a tax renewal for the Sewerage & Water Board’s drainage system.

Overview BGR analyzes a November 8, 2016 proposition that would amend New Orleans’ charter to allow for the permanent separation of the Independent Police Monitor from the Office of Inspector General.

Overview BGR explains and analyzes two tax propositions in New Orleans on April 9, 2016: one for street work and other improvements, and a second for the police and fire departments.

Overview BGR analyzes two property tax propositions meant to sustain west bank flood protection systems and three proposed St. Tammany charter amendments before voters on November 21, 2015. The tax propositions include a new tax for the West Jefferson Levee District and a tax renewal for the Algiers Levee District in New Orleans. Both levee […]

Overview This On the Ballot report informs voters in the October 24, 2015 election about a proposed quarter-cent sales tax for public safety in New Orleans’ French Quarter and a constitutional amendment allowing the State of Louisiana to invest in an infrastructure bank.

Overview BGR reviews a proposed property tax for the upkeep of public school facilities in New Orleans and 11 propositions to amend the Jefferson Parish charter that voters will decide on December 6, 2014. The charter propositions relate to: Modifying the Jefferson Parish Council’s authority to investigate parish affairs Limiting the outside employment of the […]

Overview BGR examines two proposed amendments to the Home Rule Charter of the City of New Orleans, one Orleans Parish property tax proposition and two constitutional amendments on the ballot for November 4, 2014. One City charter amendment would incorporate certain professional services contracting reforms made in 2010. The other charter amendment would move the […]

Overview In On the Ballot: October 19, 2013, BGR explains, analyzes and takes positions on three tax propositions on the ballot in Jefferson Parish and two proposed charter amendments in New Orleans, one of which would reform the Sewerage & Water Board. The Jefferson tax propositions are renewals of property taxes for the Jefferson Parish […]

Overview BGR examines charter amendments, tax propositions and state constitutional amendments on the October and November 2011 ballots. The October 22 ballot includes a Jefferson Parish charter amendment to establish the Office of Inspector General and an Ethics and Compliance Commission, as well as a related property tax to fund both entities. It also includes […]

Overview In Moonlighting: An Overview of Policies Governing Paid Police Details, BGR examines the New Orleans Police Department’s existing and proposed police detail policies and procedures, and evaluates their adequacy in light of best practices.

Overview On the Ballot: Jefferson Parish, April 30, 2011 examines four proposed tax renewals. One is a sales tax renewal for the Jefferson Parish Public School System. The other three are property tax renewals that support Jefferson Parish drainage, juvenile services, and a combination of the Parish’s animal shelters and public health facilities and the […]

BGR analyzes 10 State constitutional amendments on the ballot for November 2, 2010. The amendments concern a wide variety of issues, including: Salary increases for elected officials Allocation of State of Louisiana severance taxes Property tax exemption for disabled veterans Limiting tax increases for non-elected taxing authorities Extending the period following a disaster for retaining […]

Overview In Forgotten Promises: The Lost Connection Between the Homestead Exemption and the Revenue Sharing Fund, BGR examines the decline of the State of Louisiana’s funding mechanism for compensating local taxing bodies for the costs of the homestead exemption. The report provides data on compensation for New Orleans, Jefferson Parish and St. Tammany Parish.

Overview BGR examines two property taxes for public transit up for renewal by Jefferson Parish voters in the April 4, 2009, election.

Overview BGR provides analysis of local propositions as well as amendments to the state constitution appearing on the ballot for November 4, 2008. A proposition in New Orleans would amend the city charter to make comprehensive changes to planning and land use decision making in the city. A proposition in Jefferson Parish would expand the permissible […]

Overview The Bureau of Governmental Research analyzes four proposed amendments to the State constitution and one proposed amendment to the St. Tammany Parish home rule charter. The report covers amendments that will go before voters on October 20, 2007. Two of the proposed constitutional amendments deal with State supplemental pay for local public safety employees. The […]

Overview BGR analyzes three tax propositions to go before voters in Jefferson Parish on March 31, 2007. The propositions would renew property taxes levied parishwide or in large portions of the parish that provide funding for the public schools, recreation and drainage.

Overview BGR analyzes two of four state constitutional amendments that will appear on the November 2, 2004, ballot. The two amendments would modify the homestead exemption and the veterans’ preference to apply for civil service positions. In addition, BGR provides voters in New Orleans with information on a proposed $260 million bond issue and Jefferson […]

Overview BGR analyzes a property tax renewal for the Jefferson Parish Public School System, considering the taxpayers’ investment and its importance to the school system.

Overview In this report, BGR predicts tight financial times ahead for Jefferson Parish Government. What can the Parish Council and Parish President do about it? This report offers an array of options for keeping the parish coffers filled.

Overview Among the propositions on the ballot for October 4, 2003, are three constitutional amendments relating to coastal restoration, and another providing for the possible state takeover of failing public schools, many of which are in New Orleans. BGR analyzes these four amendments, along with two local propositions. The Jefferson Parish ballot proposition would increase […]

Overview This report examines the history and current state of the operating budget and compares revenues and expenditures, including salaries, for the City of Harahan, a municipality in Jefferson Parish. The report includes information on comparable Louisiana cities.

Overview BGR examines four dedicated property tax millages on the ballot for renewal in Jefferson Parish. Voters will decide the proposed renewals on March 27, 1999. All four of the propositions provide for the continuation of basic services such as public transit, recreation and fire protection at existing authorized millage levels.

Overview This report provides a short analysis of the potential creation of three separate neighborhood-based special tax districts in New Orleans and a recommendation on two proposed amendments to the Louisiana Constitution relative to the governance of higher education. The neighborhood districts will provide additional funding for enhanced security and in some cases, beautification and […]

Overview This issue of the BGR Outlook on Jefferson examines the Jefferson Parish School Board’s finances. The 16-page report analyzes the factors leading to recent operating budget deficits and discusses potential solutions.

Overview This report is the fourth in BGR’s program of governmental oversight and monitoring of Jefferson Parish governments. This report provides updated budgetary information on the Parish Council, District Attorney and Sheriff.

Overview This report provides an analysis and recommendations on consolidation of the six major police forces operating in New Orleans. It recommends measures short of full-scale consolidation of all forces.

Overview This is the first in a new series of reports highlighting the finances of Jefferson Parish local government. It provides an overview of parish general-purpose government revenues and expenditures over the past ten years and comparison of current-year operating budget.

Property taxes are a basic means of financing local government, but the public faces a confusing array of tax rates, taxing bodies and dedicated purposes across the New Orleans region. To help explain these taxes, the Bureau of Governmental...

Today, BGR presented a Breakfast Briefing with Anne E. Kirkpatrick, new Superintendent of the New Orleans Police Department. Thanks to our sponsor, First Horizon Bank, this event was free to the public. Click below to watch the full video...

A new report from the Bureau of Governmental Research (BGR) takes a closer look at the impacts of the City of New Orleans’ federal pandemic relief funds on its finances and budget priorities. Managing the Windfall: Tracking the City of...

Awards The Bureau of Governmental Research has received two research awards from the Governmental Research Association. BGR received a Certificate of Merit for Distinguished Research on a Local Government Issue for its method of analyzing local tax propositions in its “On...

NEW ORLEANS — From the Bureau of Governmental Research: BGR received two research awards from the Governmental Research Association at a national conference held last month in Philadelphia. In addition, BGR recently welcomed Melanie Bronfin as a new member of its...

The Bureau of Governmental Research (BGR) recently received two research awards from the Governmental Research Association (GRA) at its national conference held last month in Philadelphia. In addition, BGR recently welcomed Ms. Melanie Bronfin as a new member of...

Recruiting and keeping police officers remains a huge challenge for area law enforcement agencies, and will continue to be a problem until the perception of the job changes, Jefferson Parish Sheriff Joe Lopinto and New Orleans Police Superintendent Shaun...

As residents throughout the New Orleans area have expressed concern about crime, the Bureau of Governmental Research (BGR) presented a special Breakfast Briefing Series on Public Safety to help residents come together and explore effective steps to make New...

Today, the Bureau of Governmental Research (BGR) presented its first in-person Breakfast Briefing in more than two years. The event, made free to the public by First Horizon Bank and held in downtown New Orleans, featured New Orleans Superintendent...

Jefferson Parish residents voted Saturday to approve a 7-mill property tax increase that will generate an additional $28 million for the Jefferson Parish Sheriff’s Office. Sheriff Joe Lopinto had pitched the tax increase as a way to bring in...

Rebecca Mowbray and Paul Rioux of the Bureau of Government Research joined Newell to discuss why the JPSO tax proposition is something voters should support. Click here to listen: https://www.audacy.com/wwl/podcasts/newell-normand-20323/researchers-back-jpso-tax-proposition-1384034328 Click here for BGR’s report on the Jefferson Parish...

On the ballot for the April 30 election is a tax proposal from Jefferson Parish Sheriff’s Office. “We were very eager to look at the proposal from the JPSO because Jefferson is the most populous parish in our region,”...

NEW ORLEANS — From the Bureau of Governmental Research: BGR has released a new report titled “On the Ballot: Jefferson Parish Sheriff’s Office Tax, April 30, 2022.” The report is intended to help Jefferson Parish voters make an informed...

Today, the Bureau of Governmental Research (BGR) presented the second session of its special Breakfast Briefing series on public safety. This event, “Beyond Law Enforcement: Exploring Community-Based Strategies to Make New Orleans Safer,” featured local and national experts discussing...

NEW ORLEANS — On Friday, April 22, the Bureau of Governmental Research will host a virtual “breakfast briefing” on the topic of public safety. Scheduled from 8 a.m. to 9 a.m., the event titled “Beyond Law Enforcement: Exploring Community-Based...

When Jefferson Parish voters head to the ballot box on Saturday, April 30, they’ll decide on a potential millage increase put forward by Sheriff Joseph Lopinto to fund the hiring of nearly 250 positions and pay raises for sheriff’s...

Jefferson Parish Sheriff Joe Lopinto’s proposed 7-mill property tax to fund employee raises has picked up the backing of the Bureau of Governmental Research, which agreed with Lopinto’s assertion that increasing salaries is needed to help the agency keep...

Today, the Bureau of Governmental Research (BGR) releases a new report, On the Ballot: Jefferson Parish Sheriff’s Office Tax, April 30, 2022. The report is intended to help Jefferson Parish voters make an informed decision on whether to approve...

Today, the Bureau of Governmental Research kicked off its special Breakfast Briefing Series on Public Safety. Session 1 of the series, “Lessons from the Data: Current Public Safety Trends and Factors that Influence Them,” featured Jeff Asher, co-founder of...

After years of doing taxes the same way, Louisiana voters beginning Saturday are being asked to decide if the state should head in a different direction. Forty-three parishes, like Orleans, are choosing local leadership or deciding propositions, like East...

For years, St. Tammany Parish voters have been hearing about the looming financial plight the parish will face if a new revenue source isn’t secured for the jail and courthouse. A pair of quarter-cent sales taxes that funded those...

NEW ORLEANS — From the Bureau of Governmental Research: BGR has released a new report titled “On the Ballot: St. Tammany Parish Sales Tax, Nov. 13, 2021.” The report is intended to help voters in St. Tammany make an...

The Bureau of Governmental Research has endorsed the proposed sales tax that St. Tammany Parish government will put before voters next month, according to a report released by the agency on Thursday. BGR, a New Orleans-based non-profit watchdog group,...

A tax agreement signed Thursday with the French Quarter Management District marked the final step toward resuming enhanced police patrols in the Vieux Carré and seemingly ended a contentious process over the past 1½ years. But the agreement includes...

NEW ORLEANS – From the Bureau of Governmental Research: Today, the Bureau of Governmental Research (BGR) published a new report raising concerns about the New Orleans City Council’s recent decision to exclude hotel room rentals from the sales tax...

In August, the New Orleans City Council excluded hotel room rentals from a new sales tax for enhanced public safety in the French Quarter despite questions about whether the exclusion is permissible under state law. While BGR has not...

A special sales tax to fund supplemental police patrols in the French Quarter will be reinstated starting in October after expiring at the end of 2020. The tax was approved by voters in an April ballot measure and was...

NEW ORLEANS (WVUE) – In order to fund the “Blue Light Patrols” in the Quarter, the reinstatement of the quarter-cent sales tax is back on the ballot after the initial renewal failed in December. Because of pandemic losses, the...

NEW ORLEANS – The Bureau of Governmental Research is weighing in against a proposition for a 0.245% sales tax to pay for supplemental police patrols and other public safety services in the French Quarter. The measure will go before...

NEW ORLEANS (WGNO)– For our viewers heading to the polls this weekend, there’s a new report out that you should know about before casting your ballot. The French Quarter Sales Tax is on Saturday’s ballot and the report from the Bureau of Governmental...

Today the Bureau of Governmental Research (BGR) releases On the Ballot: French Quarter Sales Tax, April 24, 2021. The report is intended to help French Quarter voters make an informed decision on a proposition to authorize a new 0.2495% sales...

On March 20, voters in Louisiana’s Second Congressional District will choose a successor to former U.S. Rep. Cedric Richmond, who now works as a top aide to President Joe Biden. Voters in state House District 82, which encompasses Old...

The Bureau of Governmental Research (BGR) has a new report out about water and sewer tax propositions in Jefferson Parish, to be voted on in the March 20th election. Stephen Stuart is the Research Director at BGR, Susie Dudis...

JEFFERSON PARISH (WVUE) –The Bureau of Governmental Research Tuesday released a report highlighting two Jefferson Parish tax proposals related to the parish’s water and sewer systems. The two propositions will appear on the March 20 ballot. The propositions will...

NEW ORLEANS – The Bureau of Governmental Research has released a new report expressing support for two Jefferson Parish tax propositions that will appear on a March 20 ballot. BGR said the report is intended to help voters in...

The independent nonprofit group Bureau of Governmental Research is backing two Jefferson Parish tax proposals, one for its water system and one for its sewage system, according to a report released Tuesday. The proposals are the parish’s plan to...

Today, the Bureau of Governmental Research (BGR) releases On the Ballot: Jefferson Parish Water and Sewer Taxes, March 20, 2021. The report is intended to help voters in Jefferson Parish make informed decisions on two property tax propositions to...

Earlier this week, Mayor Cantrell’s Director of Strategic Initiatives Joshua Cox had a press conference wherein he accused the French Quarter Management District of not being able to administer their task force program, and of mismanaging funds. Newell invited...

The battle over security patrols in the French Quarter continues, with Mayor Cantrell’s administration remaining at odds with the French Quarter Management District (FQMD) on how previously-collected tax monies should be spent. The FQMD is currently responsible for funding...

Today, the Bureau of Governmental Research (BGR) hosted a virtual Breakfast Briefing featuring Jefferson Parish President Cynthia Lee Sheng. She discussed “Leading Jefferson Parish Today and Tomorrow: Reflections on 2020, Managing the Pandemic, and Future Priorities.” Following her presentation,...

New Orleans voters on Saturday rejected a package of ballot propositions put forward by Mayor LaToya Cantrell that would have changed how the city spent roughly $23 million a year in property taxes. The plan would have cut roughly...

NEW ORLEANS — Saturday’s tax proposition in the French Quarter just picked up a heavyweight endorsement from one of the neighborhood’s most well-known residents. New Orleans entrepreneur Sidney Torres is financing a last-minute media campaign in support of the...

Today the Bureau of Governmental Research (BGR) releases On the Ballot: French Quarter Sales Tax Renewal, December 5, 2020. The report is intended to help French Quarter voters make an informed decision on a proposition to renew a 0.2495%...

Even as it’s grown in popularity, I’ve never felt compelled to participate in early voting. I enjoy the ritual of walking to my local polling place, seeing neighbors and greeting the commissioners who show up year after year to...

NEW ORLEANS – In a new report, the Bureau of Governmental Research – a nonprofit watchdog group – recommends voters renew a 0.5-mill property tax dedicated to Jefferson Parish’s Office of Inspector General and the Ethics and Compliance Commission. BGR...

The Jefferson Parish Inspector General’s property tax renewal, which is on the ballot Nov. 3, got the thumbs up from an independent nonprofit Tuesday, when the Bureau of Governmental Research announced its endorsement. The .5-mill, 10-year property tax that...

Today, the Bureau of Governmental Research (BGR) releases On the Ballot: Jefferson Parish Inspector General Tax Renewal, November 3, 2020. The report is intended to help voters in the unincorporated areas of Jefferson Parish make an informed decision on...

The New Orleans Police Department superintendent spoke on the future of policing in the city Wednesday morning. Superintendent Shaun Ferguson took questions from Kenneth Polite, the former U.S. Attorney for the Eastern District of Louisiana. The two talked about...

NEW ORLEANS – The Bureau of Governmental Research will present a virtual breakfast briefing about the future of New Orleans policing at 8 a.m. Wednesday, Sept. 30 on Zoom. Featured guests are Kenneth Polite, the former U.S. Attorney of...

Members of the New Orleans City Council on Thursday initiated the process to renew a quarter percent sales tax in the French Quarter that has funded Louisiana State Police patrols in and around the French Quarter for the past...

Having your car broken into via smashed windows has become the new normal in New Orleans. On Tuesday, Jan. 14, a group of neighborhood associations hosted a community meeting at the Jewish Community Center to “discuss the recent uptick...

Citizens in Orleans and Jefferson parishes who plan to vote in tomorrow’s election can inform their decisions with three BGR reports: On the Ballot: Housing Tax Exemptions in New Orleans, October 12, 2019 examines Constitutional Amendment No. 4, which...

Today, BGR releases A Look Back to Plan Ahead: Analyzing Past New Orleans Budgets to Guide Funding Priorities. The report reviews the City’s General Fund budgets from 2010 to 2019, focusing on growth in revenues and changes in expenditures. As...

Today BGR releases Questions for a New Parish Council, the second in a two-part report series providing the views of candidates for Jefferson Parish government on important public policy issues. Yesterday, BGR released the responses of the candidates for...

Today BGR releases Questions for a New Parish President, the first in a two-part series of reports providing the views of candidates for Jefferson Parish government on important public policy issues. Tomorrow, BGR will release the responses of the...

JEFFERSON PARISH, La. —Residents of Jefferson Parish voted to adopt a pay raise for teachers in the parish. A pay raise for all teachers at Jefferson Parish schools passed with nearly 80% of the vote. The proposition will raise...

With a new School Board, new superintendent and new goal to improve academic performance from a C grade to an A in five years, Jefferson Parish voters agreed Saturday (May 4) to raise property taxes for public education by $28.8 million. Approval with...

Jefferson Parish voters on Saturday resoundingly approved a new 7.9-mill, 10-year property tax to fund raises for teachers and other employees. The proposal from the Jefferson Parish School Board garnered 72 percent approval. In unrelated elections, the parish’s voters...

With broad backing of the parish’s leadership, including the business community and teachers unions at one time at odds, a new pay plan for Jefferson Parish teachers and school employees is a good proposal worthy of the support of...

Voters in much of the New Orleans area will head to the polls Saturday to consider mainly requests involving taxes, as a parks and recreation tax in Orleans Parish, a teacher pay tax in Jefferson Parish and a school...

Some very critical tax measures go before the voters on Saturday. Teacher pay raises and commitments to public greenspace and facilities in both Jefferson and Orleans. Even on the second Saturday of Jazz Fest, these millages are worthy of...

Lyndsey Jackson teaches deaf children ages 3 to 5 how to communicate, to treat one another with respect and to learn, so that they’ll be ready for kindergarten. She spends part of the day on the classroom floor at...

Maybe it’s poor timing, but the leadership of Jefferson Parish has an important tax proposal for teacher pay on the ballot just as the Legislature is contemplating a $1,000 raise for teachers from the state. The teacher pay raise...

VOTERS IN NEW ORLEANS AND JEFFERSON PARISH WILL GO TO THE POLLS ON MAY 4 — during Jazz Fest — to consider several important property tax millages. In New Orleans, the sole item on the ballot is the proposed renewal...

JEFFERSON PARISH, La. —Voters in Jefferson Parish will soon decide if they want to pay more in property taxes to fund teacher pay raises. The property millage is on the May 4 ballot. The proposition would raise teachers’ pay...

NEW ORLEANS (WVUE) – In less than a month, Jefferson Parish voters will be asked to approve a property tax increase for teacher and support worker pay raises, though some voters are wondering why the tax is drawing support...

A nonpartisan research group is urging New Orleans and Jefferson Parish voters to support two tax measures that will be on the May 4 ballot. The private Bureau of Governmental Research announced Tuesday that it has endorsed a measure...

NEW ORLEANS (WVUE) – In a new report released Tuesday morning, the Bureau of Governmental Research weighs in on a proposed tax to give Jefferson Parish teachers pay raises. The BGR report comes down in favor of the proposal...

The Jefferson Parish public school system’s $28.8 million tax increase was endorsed Tuesday (April 9) by the independent Bureau of Governmental Research, which called it a “well-developed” proposal to make teacher pay competitive with other local school systems. The property tax...

Jefferson Parish’s proposed 7.9-mill public schools tax landed a significant endorsement Tuesday, when the Bureau of Governmental Research backed the measure. The tax, which will appear on the May 4 ballot, would generate nearly $29 million a year in...

Today, BGR releases On the Ballot: Jefferson Parish School Tax Proposal, May 4, 2019. The report analyzes a May 4 tax proposition in Jefferson Parish for a new 7.9-mill tax to fund pay raises for teachers and other school employees....

A 14-year-old and 16-year old were killed March 20 when the car they were in crashed into a Broadmoor beauty salon and supply store, setting it on fire after New Orleans police say the car’s driver evaded a traffic...

NEW ORLEANS — New Orleans police Superintendent Shaun Ferguson is laying out his plans for the police department’s future after taking over the helm earlier this year. Ferguson said his main objective is to get more officers on the...

New Orleans Police Superintendent Shaun Ferguson delivered an optimistic assessment Wednesday of the department he’s led since mid-January. Chief Ferguson told the nonprofit Bureau of Governmental Research that he expects the department to complete reforms outlined in the 2013...

The New Orleans Police Department’s new superintendent, Shaun Ferguson, presented at a BGR Breakfast Briefing on his vision and goals for improving public safety in the city. BGR expresses its appreciation to Supt. Ferguson and to our attendees for...

There will be several proposed changes to the state constitution on the ballot next Tuesday. One of them, Amendment 6, is meant to ease the blow of a sudden increase in property taxes. That’s something experienced by many people...

Jefferson Parish voters will take up three parishwide tax renewals when they go to the polls Nov. 6, while voters in Grand Isle and parts of the west bank also will vote on taxes for their local fire departments....

Today the Bureau of Governmental Research (BGR) releases reports to inform voters on proposed Constitutional Amendment No. 6 and three proposed Jefferson Parish property tax renewals. Tax Phase-In Constitutional Amendment On November 6, 2018, voters statewide will decide whether...

To provide New Orleans police officers with a pay raise starting in 2018, former Mayor Mitch Landrieu tapped into an initial lease payment to the city from the team redeveloping the former World Trade Center. Over the next two years, the...

Update: A clarification was added to this story to indicate that municipal taxes were not factored in the Louisiana Tax Commission’s rankings. Three parishes in metro New Orleans were in the Top 10 with the highest property tax rates among...

Covington Police Chief Tim Lentz has been selected to receive the Bureau of Governmental Research’s Excellence in Government 2018 Innovation Award for his work in initiating and implementing the Operation Angel Program, which allows complying drug addicts to seek...

Covington Police Chief Tim Lentz has received the Excellence in Government 2018 Innovation Award from the Bureau of Governmental Research for his leadership in establishing the Operation Angel Program to combat drug addiction in St. Tammany Parish. Lentz, Covington’s police chief...

Voters on the west bank of Jefferson Parish on Saturday overwhelmingly approved a new property tax that will fund critical maintenance work on the federal levees that protect the area from flooding. After rejecting a similar tax proposal in...

When it comes to taxes, essential services have to be paid for, and one of them in Louisiana more than almost anyplace else in the world is flood protection. But a property tax millage for flood protection in West...

The Times-Picayune editorial board makes the following recommendation for Saturday’s (April 28) election. JEFFERSON PARISH WEST JEFFERSON LEVEE DISTRICT PROPOSITION To increase property taxes by 4.75 mills for 10 years for maintenance of the flood control system Yes The Southeast...

Today the Bureau of Governmental Research (BGR) releases On the Ballot: West Jefferson Levee District Property Tax, April 28, 2018. On April 28, voters on the west bank of Jefferson Parish will decide whether to approve a new property tax for the...

The Jefferson Parish School Board most likely will ask voters for a tax increase next spring to fund teacher pay raises and facility upgrades, but just how much of a hike has yet to be decided. At its meeting Tuesday (Dec....

METAIRIE, LA (WVUE) – Jefferson Parish School Board members are debating which way to go next after voters narrowly defeated a measure that would have raised teacher pay. The Jefferson Parish School System is drawing more students in recent years, thanks in...

Just days after Jefferson Parish voters narrowly rejected a new property tax to fund a pay raise for public school employees, School Board members are gearing up for new tax proposals they hope to put before voters in the...

Jefferson Parish School Board member Cedric Floyd said Tuesday (Nov. 21) that he wants voters to reconsider an 8.45-mill property tax that was rejected on Saturday. The tax, estimated to generate $27 million a year, would be dedicated to teacher and...

Jefferson Parish voters on Saturday narrowly rejected an 8.45-mill, 10-year property tax that would have paid for salary increases for school system employees, tossing aside arguments that the parish’s teachers need to be paid more to make the system...

Jefferson Parish voters narrowly rejected a new 8.45-mill property tax Saturday (Nov. 18) that school officials requested to boost teacher pay. With more than 41,600 votes cast, the tax was rejected by a margin of 484 votes. The tax was proposed...

Jefferson Parish schools are asking taxpayers to vote “yes” on Saturday to a new 8.5 mil property tax. The money would be used to give teachers and school employees their first across the board pay raise in 10 years....

The Jefferson Parish public school system is asking voters to approve a new 8.45-mill property tax on the Nov. 18 ballot that school officials say is needed to boost teacher pay. The tax would help increase the starting pay of first...

It’s been a rocky few months for the Jefferson Parish School Board: Longtime member Ray St. Pierre died, parents protested shifting attendance zones on the east bank, and board member Cedric Floyd tried to get Superintendent Isaac Joseph suspended....

Early voting begins Friday across the state for the Nov. 18 election, with the runoffs for New Orleans mayor and two city council seats drawing the most attention, along with a statewide race for treasurer and other local tax...

The government agency overseeing Jefferson Parish’s two bus systems is sitting on a big pile of cash: $21.2 million. And parish officials want more. They’re asking voters Oct. 14 to renew two property taxes that fund the conventional fixed-route bus service and...

Voters throughout Jefferson Parish will be asked Saturday to renew the 6.5-mill property tax that funds the parish’s public library system, while River Ridge and a handful of Metairie voters will decide whether to pay more to become part...

The $40 million public safety plan proposed recently by Mayor Mitch Landrieu and being considered by other New Orleans officials depends on having the bulk of its upfront costs covered by the Ernest N. Morial Convention Center. The $23...

A massive expansion of the New Orleans Police Department’s surveillance capabilities, in both the French Quarter and 20 “hot spots” around the city, was unveiled Monday afternoon. The 20 “hot spots” for more cameras include Hollygrove, Mid-City, Hoffman Triangle,...