Jefferson Parish voters to decide on 8.45-mill tax hike to pay for school employee raises

By Faimon A. Roberts III

Source: The Advocate

November 4, 2017

It’s been a rocky few months for the Jefferson Parish School Board: Longtime member Ray St. Pierre died, parents protested shifting attendance zones on the east bank, and board member Cedric Floyd tried to get Superintendent Isaac Joseph suspended.

But Nov. 18 could prove a bright spot — if voters in the parish approve a new 8.45-mill, 10-year property tax to fund across-the-board raises for the system’s employees.

Supporters of the plan — notably Floyd, who has been at the center of many of the board’s recent storms — say the tax is needed to help the parish hold onto quality teachers who otherwise may leave for jobs in surrounding, and better-paying, districts.

“For our students to be competitive … our schools must be competitive,” says a recent flyer produced by the public relations consultant hired by the board to educate voters about the millage. Jefferson schools are lagging, officials have argued, because the district’s tax revenue lags behind nearby parishes.

The Jefferson Parish school system collects 22.91 mills in property tax that, based on 2016 values, generate about $82.3 million a year in revenue. Of that total, 9 mills are dedicated to teacher salaries and benefits. The new tax would generate about $27 million per year.

For the owner of a $200,000 house, the new tax would cost about $105 per year.

Other large school districts in the state, including East Baton Rouge, Caddo and St. Tammany, have higher millage rates. Caddo and St. Tammany both collect more than 65 mills, East Baton Rouge 43 mills.

Revenue from the tax would fund a $4,000 raise for teachers and a $3,000 raise for most other employees. Employees whose salaries are under $20,000 would get a 10 percent raise.

Jefferson Parish starting teacher salaries are just under $41,000 per year, last among Plaquemines, St. Charles, St. Tammany, Ascension, St. John the Baptist and Orleans parishes, according to data provided by the Jefferson board. A $4,000 increase would make Jefferson second only to Plaquemines Parish.

“Our most urgent need is for employee pay,” Joseph said. “If we have highly qualified, highly certified teachers, we will see better outcomes in student performance.”

Jefferson loses about 400 teachers per year, he said, though he acknowledged those departures are not all related to pay. But, he said, the state’s largest and most diverse school district faces unique challenges that will be partially addressed by paying teachers better.

But, Joseph acknowledged, the district’s effort to get this millage passed is complicated by the expectation that it will ask for another new tax next spring after a consultant completes a review of the district’s facilities.

Officials have long said that major facilities upgrades are needed, and that’s why some members grumbled when Floyd, with little warning or analysis, pushed the board to put this tax on the fall ballot.

Floyd declined a request for an interview for this article, but earlier this fall, he rejected that criticism. The school system, he said, has been discussing a facilities upgrade millage for years, but nothing has ever been put before the voters, and there is no guarantee that one will make it to the ballot next year either.

He persuaded six of his colleagues to vote with him to put the employee pay millage before the voters by framing it as a vote in support of the system’s most vital employees.

Those employees could also be key to the measure’s fate. With few other items on the ballot, the election is expected to draw a low turnout Nov. 18, and Joseph noted that the system is hoping most of its 7,000 employees will go to the polls.

“We are trying to motivate our yes vote,” he said.

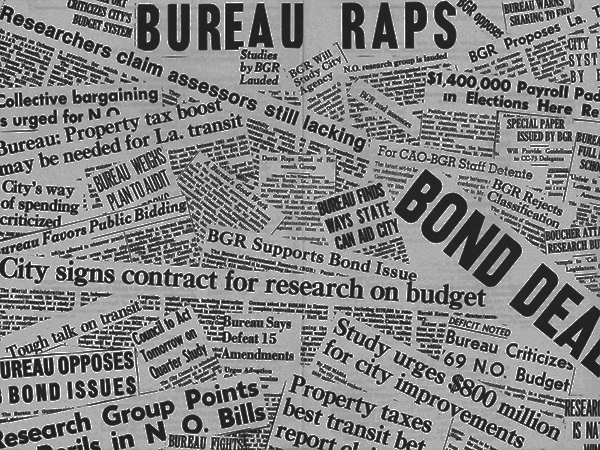

Not everybody is on board with the proposal. The Bureau of Governmental Research, a private, independent research agency, has come out against the tax, accusing the School Board of having “rushed into this millage proposition without a comprehensive benchmarking analysis to determined whether the pay increases are fair, reasonable and appropriately scaled to the labor market.”

The BGR also questioned the underlying assumptions that drove the tax proposal.

The board “has shown little evidence of a problem retaining employees other than early-career teachers,” the bureau’s report said.

Noting that the district also needs to improve its facilities, it concluded, “Before the School Board asks voters for a major tax increase, it should comprehensively examine its funding needs and priorities.”

Early voting will run through Saturday except for Friday, which is a holiday.

Fair Use Notice

This site occasionally reprints copyrighted material, the use of which has not always been specifically authorized by the copyright owner. We make such material available in our efforts to advance understanding of issues and to highlight the accomplishments of our affiliates. We believe this constitutes a “fair use” of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is available without profit. For more information go to: US CODE: Title 17,107. Limitations on exclusive rights: Fair use. If you wish to use copyrighted material from this site for purposes of your own that go beyond “fair use,” you must obtain permission from the copyright owner.