Jefferson Parish voters narrowly reject property tax for schoolteacher raises

By Faimon Roberts

Source: The Advocate

November 18, 2017

Jefferson Parish voters on Saturday narrowly rejected an 8.45-mill, 10-year property tax that would have paid for salary increases for school system employees, tossing aside arguments that the parish’s teachers need to be paid more to make the system more competitive with neighboring districts.

With all 271 precincts reporting, the measure failed by a 51-49 margin, with “no” votes outnumbering “yes” votes by 484.

The final vote will create new worries within the school system about the chances of an expected future millage proposal, this one aimed at financing facilities upgrades.

It also will likely roil the politics of the School Board: Saturday’s vote was the brainchild of often-controversial board member Cedric Floyd, who introduced the idea, persuaded six of his colleagues to put it on the ballot, and then helped craft the messaging aimed at getting voters to approve it.

Floyd’s push for the tax was controversial: Even though some of this colleagues voted for it, some questioned the way it had been presented. Floyd only told board members the amount of the millage hours before the vote. Several assumed that no such tax would be discussed until after a review of the system’s facilities — currently under way — was completed.

The tax also represented a significant increase in the amount of property tax that Jefferson homeowners pay for their school system. Right now, they pay 22.91 mills per year, which brings in about $82 million per year. Of that, 9 mills is dedicated to teacher pay.

The 8.45 mills would have brought in an additional $27.9 million each year. It would have cost the owner of a $200,000 house with a homestead exemption roughly $105 per year. The idea was to give the system’s more than 6,600 employees a sizable pay raise: 10 percent for every employee who makes under $20,000 per year, $4,000 for teachers and $3,000 for all others.

The raise was necessary, tax proponents argued, to bring Jefferson’s teacher salaries in line with surrounding parishes. A teacher starting in the parish earns $40,949. That’s the lowest in the region, and officials said the tax was needed to help slow attrition.

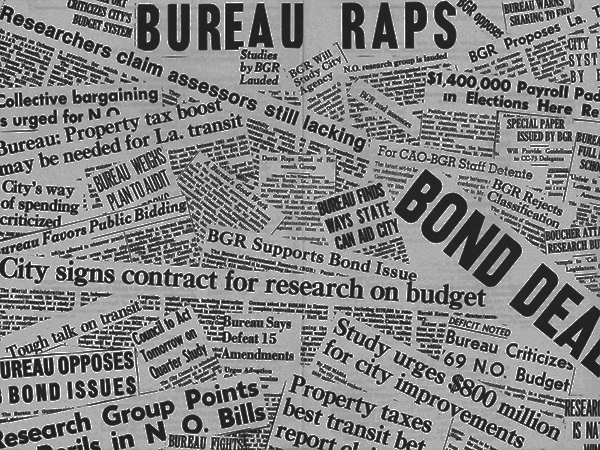

But others, including the nonpartisan Bureau of Governmental Research, disagreed. The group acknowledged that the pay for starting teachers is lower than surrounding parishes, but noted that the parish’s average teacher pay, $49,923, is competitive. It also questioned whether the pay raises would be effective in helping to retain teachers and critiqued the school system for not getting a comprehensive salary study before proposing the raise.

“The School Board made this decision in short order, with little public deliberation on the school system’s long-term needs and priorities,” the report said.

The group also pointed out the system’s need for better facilities, and suggested that that need might be more urgent.

“Many buildings are outmoded and cannot be easily renovated to address new technology and learning environments,” the report noted.

Teacher pay increases may be put before voters again fairly soon, however. One board member, Larry Dale, said if the tax failed, a new proposal should be drawn up, one that increases teacher pay and also helps pay for improvements to facilities.

Fair Use Notice

This site occasionally reprints copyrighted material, the use of which has not always been specifically authorized by the copyright owner. We make such material available in our efforts to advance understanding of issues and to highlight the accomplishments of our affiliates. We believe this constitutes a “fair use” of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is available without profit. For more information go to: US CODE: Title 17,107. Limitations on exclusive rights: Fair use. If you wish to use copyrighted material from this site for purposes of your own that go beyond “fair use,” you must obtain permission from the copyright owner.