The Bureau of Governmental Research (BGR) has updated its interactive Property Tax Dashboards with the latest rates for Jefferson, Orleans and St. Tammany parishes. First launched at the beginning of 2024, the dashboards help residents, business owners and policymakers navigate the complexities of property tax rates, taxing bodies and dedicated purposes across the three parishes.

The update reveals most millage rates were lowered in Jefferson and St. Tammany, after parishwide reassessments in 2024 increased total property value in most individual tax districts or wards.

Major takeaways by parish include:

Jefferson Parish (latest rates are for 2024 tax year)

- The 2024 reassessment increased the total value of property in the parish by 5.6%.

- Following the reassessment, the parish’s taxing authorities reduced, or “rolled back,” their rates as required by law to keep tax collections revenue neutral. Most taxing authorities maintained those lower rates and did not exercise their option to increase, or “roll forward,” their rates up to the allowed maximum rate and receive new revenue. As a result, the median total rate across Jefferson’s tax wards fell to 130.89 mills, a 4.13-mill reduction from 2023. All but three wards saw a decrease in their total rate.

- Total rates for Jefferson Parish’s wards now range from 100.18 mills to 150.75 mills. BGR’s dashboards breakdown these total rates, so you can see where your taxes go, as shown in the sample chart below.

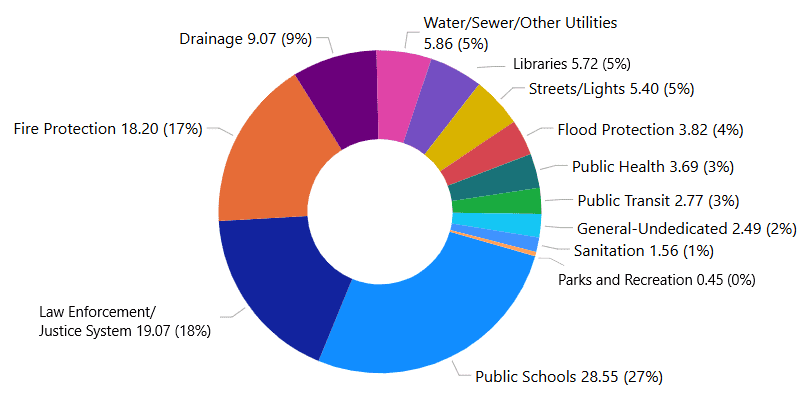

Breakdown by Purpose of the 2024 Total Property Tax Rate for the City of Kenner (Jefferson Parish, Ward 92)

Figures are number of mills and the percentage of the 106.65 total millage rate for this area

Excerpt of a BGR Property Tax Dashboard, available at BGR.org. A mill is one-tenth of one percent, or $1 for every $1,000 of taxable assessed value. For more information, check out BGR’s overview of property taxes in Louisiana.

St. Tammany Parish (latest rates are for 2024 tax year)

- St. Tammany’s 2024 reassessment increased the total value of property in the parish by almost 22%.

- Taxing authorities rolled back their rates to make the increase revenue neutral. Most taxing authorities opted to levy the reduced rates instead of rolling their rates forward and realizing new revenue. As a result, the median total rate across St. Tammany’s tax districts fell to 130.8 mills, an 8.29-mill reduction from 2023. All districts saw a decrease in their total rate.

- Total rates for the tax districts now range from 98.47 mills to 154.48 mills.

Orleans Parish (latest rates are for 2025 tax year)

- This wasn’t a reassessment year for New Orleans, and the parish’s taxing authorities largely maintained the previous year’s rates. The total rate fell slightly due to a 2-mill decrease in the rate required to pay the City’s general obligation bond debt.

- The total rate for most East Bank residents is now 131.99 mills. The rate is marginally higher in Algiers at 132.01 mills due to a slightly higher levee district tax.

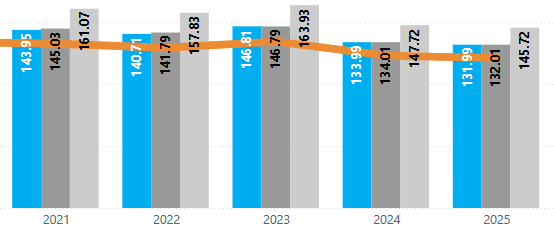

- Total property tax rates decreased for the second year in a row, as shown in the following snapshot from BGR’s Property Tax Dashboards. The full dashboard online presents a 10-year lookback.

Most Recent 5-Year Trend in the Total Millage Rates for New Orleans

Figures in mills

The Property Tax Dashboards provide complete rate details for each individual taxing area within the parishes. They are a one-stop resource for answering the most common property tax questions:

- What is my total rate?

- Where does the money go?

- How does a home’s value change its tax bill?

- Who sets the rate and levies each tax?

- How have rates changed over time?

Explore the dashboards by clicking the View Tax Dashboards button below. The website is easy to use – select a parish and then click on a map of a taxing area, such as Algiers, River Ridge or Mandeville. The dashboard for that area will display in a new tab in your browser. The dashboards are best viewed on a desktop or laptop screen, but you can also view them on a mobile device. The website includes a video tutorial on how to get the most out of using the dashboards. BGR has also paired the dashboards with an online guide to the basic nuts and bolts of property taxes.