Who can levy property taxes?

The State of Louisiana allows many local governmental entities to levy property taxes. Examples include parish and municipal governments, school boards and some fire districts. In most cases, a local taxing body must obtain voter approval to levy a new tax or renew an existing one. These taxes typically have a fixed term, which requires renewal before they expire. However, some property taxes are established in the state’s constitution or other state law. These are permanent and do not require voter renewal.

In some cases, state law gives one government entity authority over levying and setting the rates for another government entity’s property taxes. For example, the New Orleans City Council levies the taxes for both the Sewerage and Water Board and the Downtown Development District.

What are dedicated and undedicated taxes?

Most property taxes in Louisiana are dedicated. This means the revenue can only be used for certain purposes. Typically, these dedications are specified in the ballot proposition approved by voters. Across New Orleans, at least 90% of the total property tax rate is dedicated; the percentages are even higher in Jefferson and St. Tammany.

Dedications can vary widely. Some taxes may be considered dedicated simply because they are levied by a special-purpose government entity like a school district, law enforcement agency or levee district. Special-purpose governments can further dedicate individual property taxes to more specific uses. Common examples include personnel costs, capital projects, or supplies and equipment. General-purpose governments like parishes and municipalities can also have taxes dedicated to specific functions. Examples include taxes for maintaining streets, providing police or fire protection or operating public health programs.

Parish and municipal governments typically have at least one undedicated property tax. They can use the revenue from undedicated taxes for any purpose or combination of purposes.

How do I calculate my tax bill?

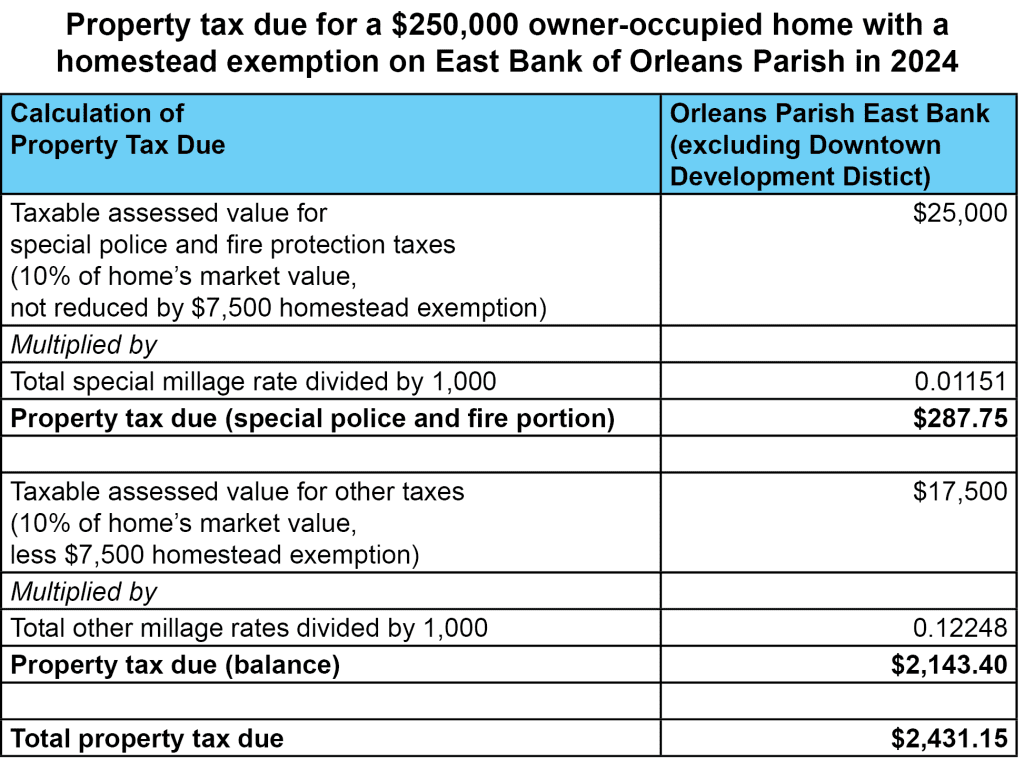

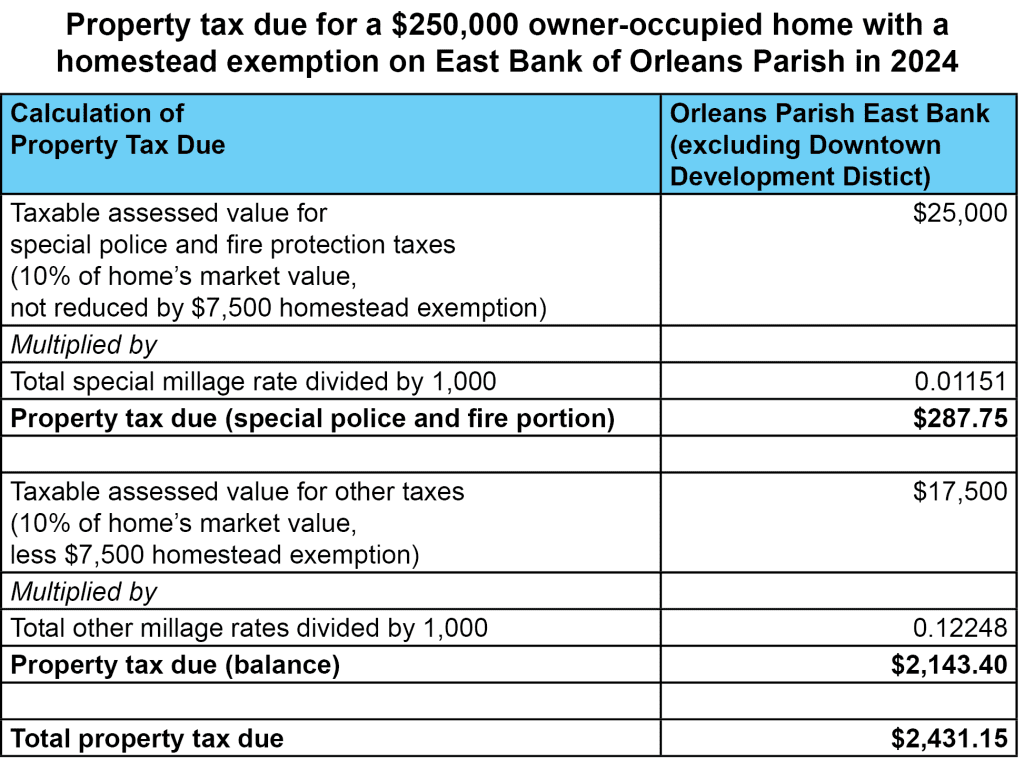

Property taxes are based on the assessed value of your property, less any applicable tax exemptions. This is called the “taxable assessed value.” In Louisiana, the assessed value of land and residential buildings is equal to 10% of market value as estimated by the parish assessor. The assessed value of commercial buildings is equal to 15% of market value as estimated by the assessor. Louisiana’s homestead exemption reduces the taxable assessed value of most owner-occupied homes by $7,500, which equates to $75,000 of the market value.

All parishes except Orleans wait until the end of the year to bill their property taxes. For example, the Jefferson and St. Tammany tax bills for the current year are mailed in late fall and due by December 31. In Orleans Parish, tax bills for the current year are typically mailed on or before January 1 and due by January 31. In 2024, however, Orleans Parish bills were delayed one month.

However, the homestead exemption generally does not apply to taxes levied by municipalities. So, for municipal tax purposes, the taxable assessed value of an owner-occupied home is not reduced by the $7,500 exemption. The City of New Orleans, a consolidated city-parish government, is an exception. The homestead exemption does apply to its taxes, except for certain police and fire protection taxes specified in the Louisiana Constitution.

Property tax rates are expressed in mills, hence the term “millage.” A mill is one-tenth of one percent, or $1 for every $1,000 of taxable assessed value. Different taxing entities charge different millage rates. Their combined millages make up your total tax rate.

To calculate the amount of tax due, first divide the number of mills levied by 1,000. Then multiply the result by the taxable assessed value of the property. If you live in a city, town or other incorporated area, the calculation is more complex because the homestead exemption applies to one portion of your taxes but not to the portion levied by the municipality. You must calculate municipal and non-municipal taxes separately and add them together. This is your total taxes due.

The charts below illustrate the calculations for a $250,000 home in selected municipalities and unincorporated areas of Jefferson and St. Tammany parishes, and on the East Bank of Orleans Parish.

How do taxing bodies set their millage rates?

Louisiana requires taxing bodies to set their rates annually during a public meeting. They can levy up to the maximum rate in effect at that time. However, following a parishwide property reassessment, state law adds a step.

The Louisiana Constitution requires assessors to reassess all property in a parish at least every four years.[1] After a reassessment, local taxing bodies must adjust their rates so that tax collections remain at the same level as the previous year.[2] When property values rise, taxing bodies must reduce, or “roll back,” their millage rates to keep collections revenue neutral. However, State law allows taxing authorities to then increase, or “roll forward,” their rates up to the allowed maximum rate. Rolling forward requires a public hearing and a two-thirds vote of the taxing authority.[3] If a taxing body does not exercise its roll forward option before the next mandatory reassessment period, the rolled-back rate becomes the new maximum rate.

Roll back and roll forward requirements do not apply to taxes dedicated to paying general obligation bond debt. Taxing bodies set those rates annually based on the established debt payment schedule. The levied rate must generate sufficient revenue to cover the year’s debt service obligation.

While a roll back is designed to keep total tax collections at the same level, it does not prevent changes in individual tax bills. For example, a house that experienced above-average growth in assessed value could still see its bill rise after a full roll back of all tax rates. However, the increase would be less than if taxing bodies had opted to roll forward.

How much revenue does one mill produce?

The amount of revenue one mill produces depends on where the tax is levied. A 1-mill tax levied parishwide will generate more than a 1-mill tax levied for a recreation or fire district within the same parish. And a 1-mill parishwide tax generates more revenue in Orleans Parish than in St. Tammany. The amount of revenue depends on the taxable assessed value of all property in the geographic area. Homestead exemptions and exemptions for certain commercial property such as those available through Louisiana’s Industrial Tax Exemption Program (ITEP) reduce the taxable assessed value of property in many areas. Property owned by government entities and nonprofit organizations is also exempt and can significantly reduce an area’s taxable assessed value.

Calculating how much one mill produces is straightforward. Simply divide the area’s taxable assessed value by 1,000. For each $1 billion of taxable assessed property value, a mill will generate $1 million. This assumes a 100% tax collection rate, i.e., the taxing bodies receive all taxes billed.

Generally, the amount of revenue a mill generates parishwide increases annually due to new construction. Reassessment years typically see the largest growth because they also reflect property value increases other than those driven by new construction. The chart below shows how much one parishwide mill has generated in Jefferson, Orleans and St. Tammany parishes.

BGR calculations based on the total assessed value of property, net of homestead exemptions, in each parish as reported in the Louisiana Tax Commission’s annual reports and information provided by the parishes’ assessors. The calculations assume a 100% property tax collection rate.

[1] La. Const. Art. VII, Sec. 18(F).

[2] La. Const. Art. VII, Sec. 23(B). Calculating the adjusted rate does not include growth in the assessed value of property due to new construction – property going on the tax rolls for the first time.

[3] La. Const. Art. VII, Sec. 23(C) and La. R.S. 47:1705.