New Orleans would get larger share of taxes on short-term rentals under bill filed this week

By Jeff Adelson

Source: The Advocate

March 30, 2017

A larger share taxes generated by short-term rentals on platforms such as Airbnb would go to New Orleans rather than entities like the Ernest N. Morial Convention Center or Convention and Visitor’s Bureau under a bill filed for the upcoming legislative session.

The measure, House Bill 224, does not change the amount of sales tax that would be imposed on short-term rentals and does not alter the amount that various other agencies collect when those taxes are imposed on traditional hotels.

But it would mean the city would get millions in taxes generated by the short-term rentals, which would be put in a special fund dedicated to “the quality of life of residents,” including code enforcement, law enforcement, sanitation, emergency medical services, fire protection and street repairs.

“It’s a step in the right direction,” said state Rep. Helena Moreno, D-New Orleans, who sponsored the bill. “I think we need to add more money toward these particular services and that’s what I hear from citizens all the time.”

Guests in New Orleans hotels currently pay a variety of taxes and assessments totaling about 15.75 percent of the bill. The city gets 1.5 percentage points of that tax, or less than 10 percent of the total.

Moreno’s bill would change the formula for taxes on short-term rentals, giving the city 3.97 percentage points of the taxes that are now collected by the state and distributed to other entities. The Louisiana Stadium and Exposition District — which oversees the Superdome — would give up 2 percentage points in taxes on short-term rentals; the Convention Center would give up 1 percentage point; and the CVB would give up .97 percentage points.

Another 1 percent of the state tax on hotels and motels would continue to go to state and the other .03 percentage points to promoting tourism in Louisiana.

Because short-term rentals only started paying taxes in New Orleans this year under rules that don’t technically take effect until Saturday, Moreno said the change does not mean any of the agencies are giving up anything they’re already getting.

City officials have estimated that each percentage point of the sales tax on short-term rentals will generate about $600,000 a year from the thousands of rentals in the city, Moreno said. If the bill passes, that would mean about $2.4 million more for the city.

“Anytime there’s more tax dollars flowing into the city’s general fund for vital services, the better,” Deputy Mayor Ryan Berni said.

At least one of the agencies that would have to give up some future revenues doesn’t seem to have a problem with the bill. LSED Chairman Kyle France said he doesn’t see any problem with the measure since it doesn’t effect any revenue the agency is now receiving.

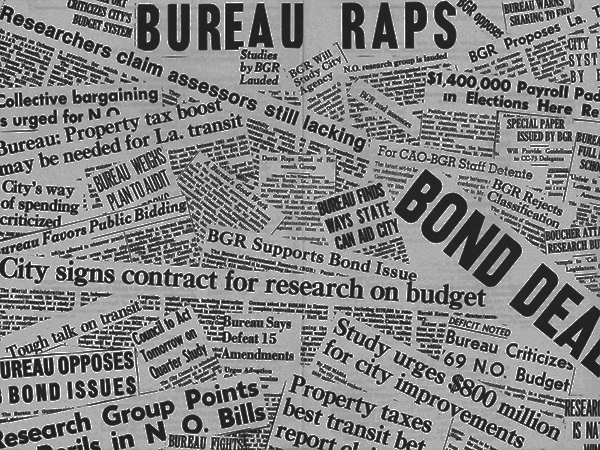

Getting a larger share of hotel and motel taxes into city coffers has been a long-time goal of Mayor Mitch Landrieu’s administration. The amount of money that now goes to other agencies has also been highlighted by reports from the non-partisan Bureau of Governmental Research, a New Orleans-based think tank, which released a report in late 2015 that questioned whether a variety of taxes — including the hotel and motel taxes — were being put toward uses residents see as priorities.

“BGR has called for a comprehensive reassessment of the local tax structure in New Orleans with an eye toward rededicating taxes to address the community’s most pressing needs,” BGR President and CEO Amy Glovinsky said in an email. “A key piece of that review is to examine the use of hotel taxes. To the extent House Bill 224 seeks to rationally align hotel tax revenue with underfunded critical needs, it may be a step in the right direction.”

Fair Use Notice

This site occasionally reprints copyrighted material, the use of which has not always been specifically authorized by the copyright owner. We make such material available in our efforts to advance understanding of issues and to highlight the accomplishments of our affiliates. We believe this constitutes a “fair use” of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is available without profit. For more information go to: US CODE: Title 17,107. Limitations on exclusive rights: Fair use. If you wish to use copyrighted material from this site for purposes of your own that go beyond “fair use,” you must obtain permission from the copyright owner.