One of the fiscal consequences of the public health emergency for New Orleans K-12 public education is plunging sales tax revenue. Reduced national and global travel and the Louisiana’s stay-at-home order have upended many businesses, including those in the city’s hospitality and retail sectors. As the school system addresses the budget impacts of decreased sales tax revenue, it’s important for policymakers and the public to understand the broader funding framework that supports New Orleans’ charter-centric public school system.

The Bureau of Governmental Research (BGR) report, Learning Curve: A Guide to Navigating School Funding in New Orleans’ Unified District, presents a comprehensive explanation of more than $650 million of K-12 public education funding in New Orleans. It describes and analyzes the funding framework as it stands less than two years since the unification of the city’s school system under the control of the Orleans Parish School Board and its district, NOLA Public Schools. While BGR completed the report in March before the full onset of the public health and economic crises in Louisiana, the report’s analysis can inform emerging discussions of declining sales tax revenue and other school funding challenges New Orleans will face in the months ahead.

Insights on School Sales Tax

As noted in the report, local sales and property taxes are the largest source of revenue for K-12 public education in New Orleans, accounting for 48% of total system revenue in fiscal year 2018. Local sales tax provided about 22% of total system revenue. It provided about 20% of charter schools’ share of total revenue. BGR’s report compiled data from 2018 to analyze funding because this was, at the time, the most recent year for which actual revenue amounts were available for all sources.

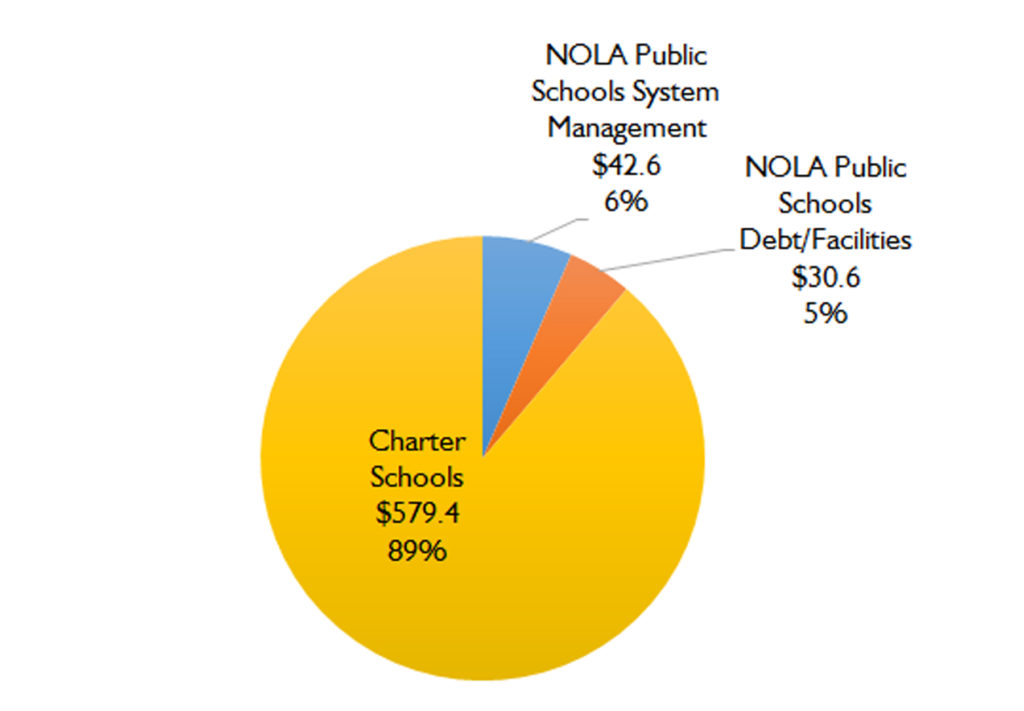

In New Orleans today, charter schools receive the vast majority of public education funding. About one-tenth goes to NOLA Public Schools, the parishwide school district, for system management and debt service and facilities obligations, as shown in the chart. Sales tax annually provides a significant portion of NOLA Public Schools’ revenue for facility debt service, capital repairs and replacement.

NOLA Public Schools received about eight months of the current fiscal year’s sales tax collections prior to the onset of the crisis. It’s uncertain how far sales tax collections will decline during the remainder of this fiscal year. Through the end of April, the City had collected about 91% of 2020 property taxes billed. New Orleans’ annual property tax collection rates have been around 95% in recent years, so the potential percentage shortfall in collection of this year’s property tax revenue is less than for sales tax.

However, the school system’s sales tax decline in the current fiscal year, which ends on June 30, 2020, will not alter this year’s payments to charter schools. Louisiana law bases charter schools’ local property and sales tax revenue on the prior year’s collections. This means that charter schools will receive the 2019 level of local tax collections this fiscal year. If current-year tax revenue ends up exceeding the 2019 level, Louisiana law requires NOLA Public Schools to distribute the excess revenue to charter schools during the next year. If tax revenue falls short of the 2019 level, state law allows NOLA Public Schools to carry the loss forward and recover it from excess revenue in future years. It would take a sales tax decline of 16% from the 2019 level to negate the $23.1 million gain in property tax revenue in the current fiscal year, assuming the typical collection rate, resulting from the citywide reassessment and NOLA Public Schools’ roll-forward of its millage rates.

Looking ahead to the next fiscal year, which begins July 1, 2020, BGR estimated that this increase in property tax revenue would boost charter schools’ local tax funding by about $450 per pupil. Again, a decrease in sales tax revenue would offset the projected increase.

Falling sales tax revenue will likely prevent NOLA Public Schools from meeting its annual revenue expectations for its facility capital repairs and replacement fund. The district is building this fund up over time to provide the resources necessary for preserving New Orleans’ school facilities. In fall 2019, the district had projected funding would likely fall short of facility needs, so any reduction in sales tax revenue will widen the gap.

Although BGR’s Learning Curve report does not specifically address impacts of the public health and economic crises, it provides additional discussion of sales tax and the many other resources that support New Orleans’ unique decentralized public education system. The laws, regulations and practices that compose New Orleans’ public education funding framework are generally effective but complex, and their outcomes are not always clear or accessible. The report serves as a guide for policymakers, charter school administrators and board members, education advocates, interested parents and other members of the public who must grasp the complete funding picture in order to develop and promote effective changes.

Further, Learning Curve highlights specific areas where changes can strengthen the funding framework and encourage further innovation in the all-charter district model. For charter school funding, it finds opportunities to:

- Strengthen the underlying analysis for the New Orleans funding formula.

- Better align federal formula grant funding with school needs.

- Increase federal funding from Medicaid for health and behavioral health services schools provide students.

- Increase accountability for public funds used by charter schools slated for closure.

- Develop policies to better allocate excess local tax revenue.

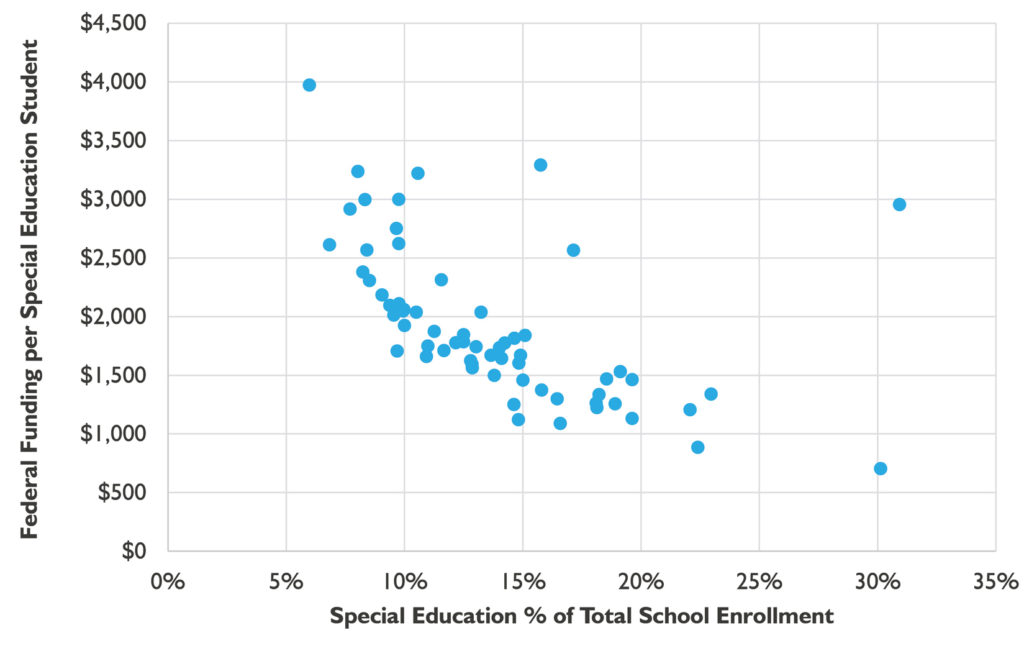

Pursuing these opportunities could improve resource allocation to schools and, in the case of Medicaid, increase schools’ funding from existing sources. To illustrate one funding concern, the chart below shows how federal grant allocation methods often provide schools with high concentrations of special education students with less funding for these students’ educational needs.

ALLOCATIONS OF FEDERAL SPECIAL EDUCATION FUNDING PER STUDENT IN NEW ORLEANS CHARTER SCHOOLS, 2017-18 SCHOOL YEAR

BGR further finds that NOLA Public Schools can improve its financial stewardship of the system by:

- Strengthening policies governing its General Fund reserves to ensure sustainability of this critical systemwide resource.

- Making its financial reporting more transparent so the community can understand how the district allocates revenue from multiple sources to core functions and programs.

- Exploring whether there are opportunities to improve the current division of school and central management functions to achieve better fiscal and practical outcomes.

Addressing these areas would enable the nation’s most decentralized school system to more fairly, prudently and transparently allocate public resources. To read more from Learning Curve, please click below for the full report, a two-page summary and the media release.