As the New Orleans City Council reviews the proposed 2020 budget for the City of New Orleans, BGR presents here a collection of resources to help citizens understand the proposal in the context of recent City budget trends and local government finance.

Where to Find City Budget Information

A copy of the City’s proposed 2020 operating budget is available here. The City houses a collection of budget documents here. The New Orleans City Council provides information about the proposed budget on its website, as well as a schedule and videos of public hearings on the budget in November 2019. Click here to access the council’s website.

How BGR Can Help You Stay Up to Date

- Get immediate notice of future BGR releases on City finances and other local government issues by joining our free email list. Click here to subscribe.

- Another great way to stay informed is to subscribe to our free daily email of local public policy news stories. Our research team combs through more than a dozen news sites to find significant stories about local government and public policy in the New Orleans metro area, and compiles them into The Daily Dispatch. Click here to subscribe.

- Follow BGR on social media. We share highlights of our work and links to new research on Twitter, Facebook, Instagram and LinkedIn.

BGR Research on the City’s Budget

- BGR Now: A Framework for Assessing New Orleans’ Proposed 2020 Budget (October 31, 2019) outlines key findings of BGR’s recent City budget study, A Look Back to Plan Ahead, and connects them to the current 2020 budget process to help inform citizens and policymakers.

- A Look Back to Plan Ahead (October 3, 2019) reviews a decade’s worth of the City’s General Fund budgets from 2010 to 2019. It tracks the strong growth in revenues during that period and analyzes the sources of the growth. The report also examines changes in expenditures to identify shifting priorities and the factors driving them. It does so by looking specifically at departments and purposes with notable funding changes, including police, jail operations, recreation and sanitation. It then reviews how the key findings from this analysis can help the City make better use of its existing resources. Finally, BGR makes recommendations informed by this report and BGR’s other recent research on taxes and government finance in New Orleans. Read the full report, an InBrief summary and the media release.

Sharing Our Findings

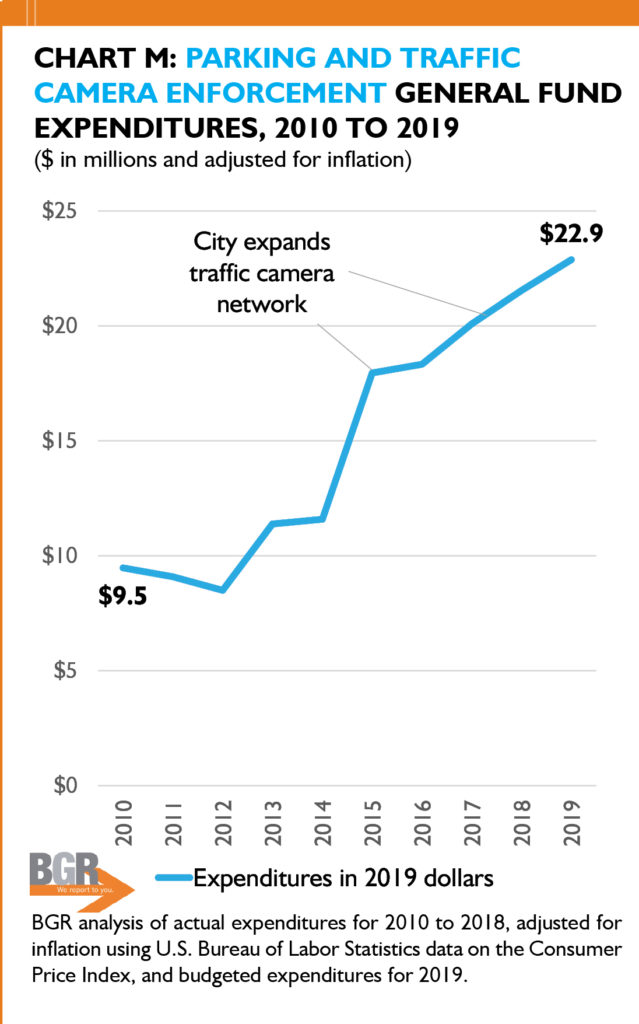

- In comments at the City Council’s budget hearing for the Department of Public Works (November 11, 2019), BGR urged the City Council to explore the factors driving the increasing costs of enforcing parking and traffic camera violations, a trend BGR revealed in A Look Back to Plan Ahead (pages 28-29).

- BGR noted that enforcement costs have grown at a faster rate than the additional revenue the City has received from expanding the traffic camera network and increasing parking meter fees. In 2010, enforcement costs consumed 26% of revenues from parking and traffic camera citations. That figure had climbed to 44% by 2019, and it would increase further to 46% in the proposed 2020 budget. If these enforcement costs had remained at 26% of revenues as they were in 2010, the City would have an additional $11 million in next year’s budget. Mining for cost savings is critically important as the City works to identify funding for streets, drainage and other critical needs. Watch the Public Works budget hearing and see BGR’s comments (at about the 4 hour mark):

- BGR discussed A Look Back to Plan Ahead with Oliver Thomas on WBOK-1230 AM’s program, The Good Morning Show, on October 15, 2019. To listen to that show and see some of the report data we discuss, play the video below.

November 16 Bond and Tax Propositions

As the City Council deliberates on the proposed budget, New Orleans voters will head to the polls on November 16 to decide three separate propositions that would authorize the City of New Orleans (City) to:

- Issue up to $500 million in bonds for capital improvements.

- Levy a new 3-mill property tax that would yield $12 million annually for maintenance of City infrastructure, facilities and equipment.

- Levy a new occupancy tax on short-term rentals that would yield several million dollars annually to fund infrastructure of the City and Sewerage and Water Board and promote tourism.

The propositions are part of the City’s effort to increase funding for infrastructure improvements and other municipal needs. On the Ballot: New Orleans Bond and Tax Propositions, November 16, 2019 analyzes each proposition. The report provides a separate overview, relevant background information, and an analysis grounded in BGR’s mission of promoting the efficient and effective use of public resources. It also provides BGR’s position on each proposition.

A Broader Look at Orleans Parish Tax Revenues

Earlier this year, BGR published a report that examined all local tax revenue in Orleans Parish, covering tax received by the City and other local government bodies. Entitled The $1 Billion Question Revisited: Updating BGR’s 2015 Analysis of Orleans Parish Tax Revenues, the report breaks down 2019 projected local tax revenue by recipient and by purpose, comparing the results to 2015. The report then reviews progress toward reevaluating tax allocations to identify funding for high-priority needs, including those of City government.